Traditional spreadsheets are error-prone, time-consuming, and don't account for Michigan-specific tax rates. In todays markets, inaccuracies like these can make or break your investment. You need accurate, comprehensive analysis to make confident investment decisions—fast.

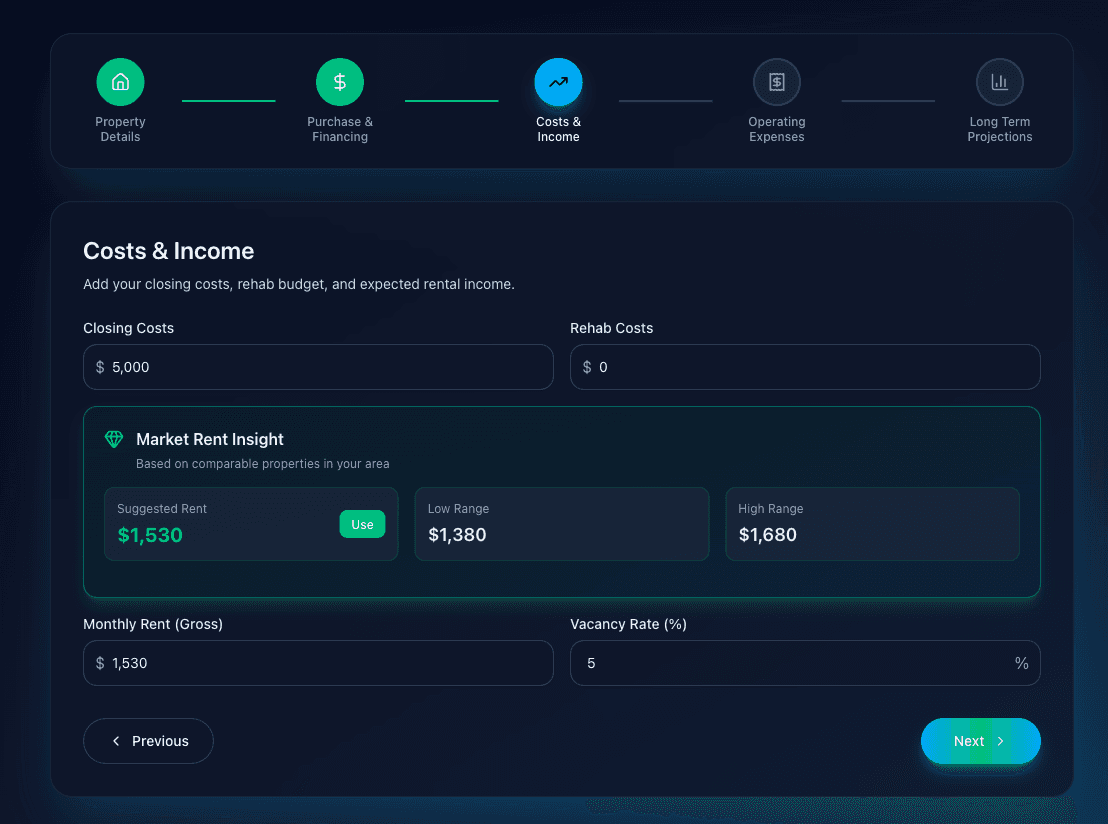

Our intuitive multi-step form guides you through property analysis with smart address lookup, and automatic tax rate detection. We limit mundane data entry and make it easy and fast.

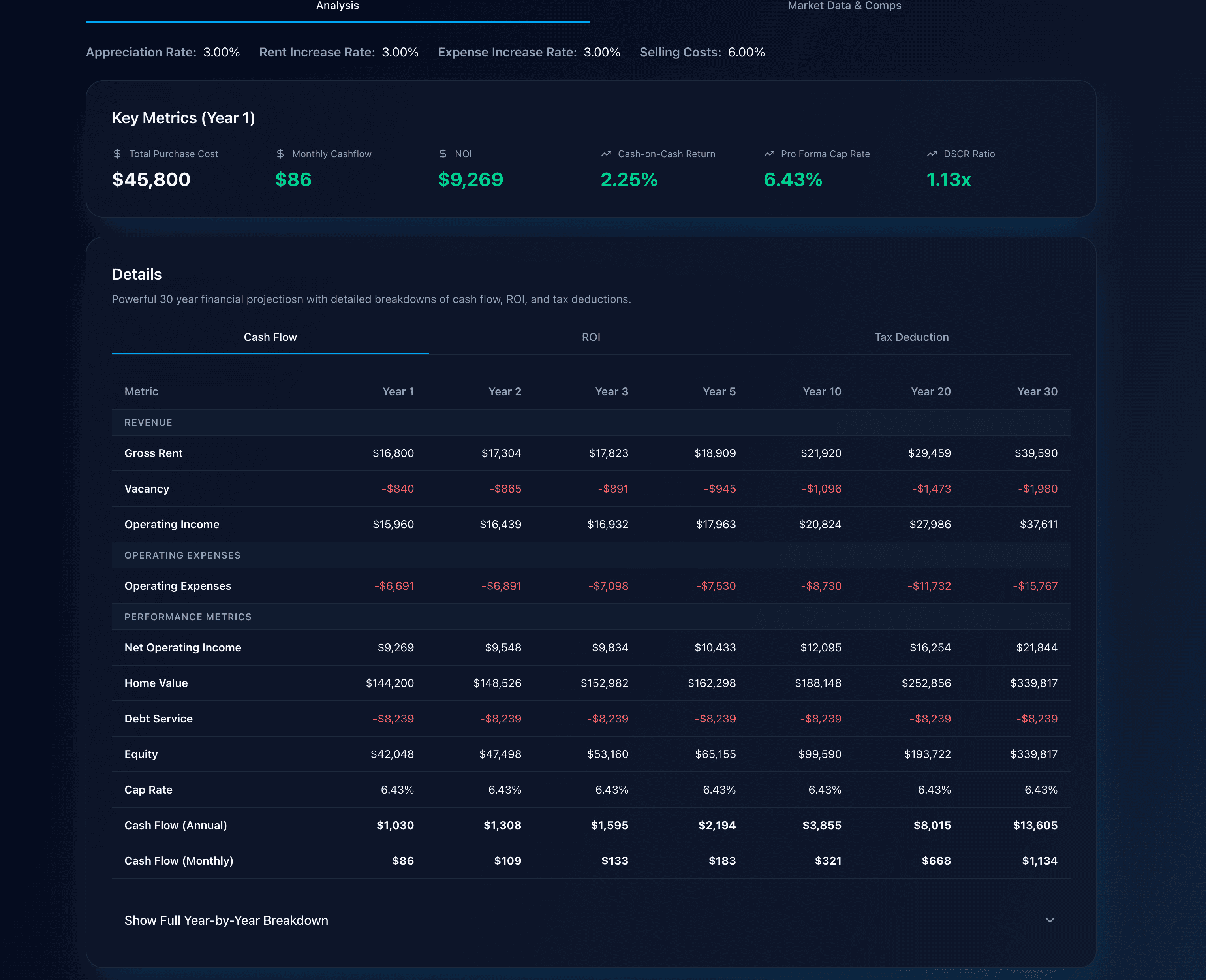

Get comprehensive analysis with cash flow calculations, ROI metrics, tax deductions, and 30-year projections—all calculated automatically with precision.

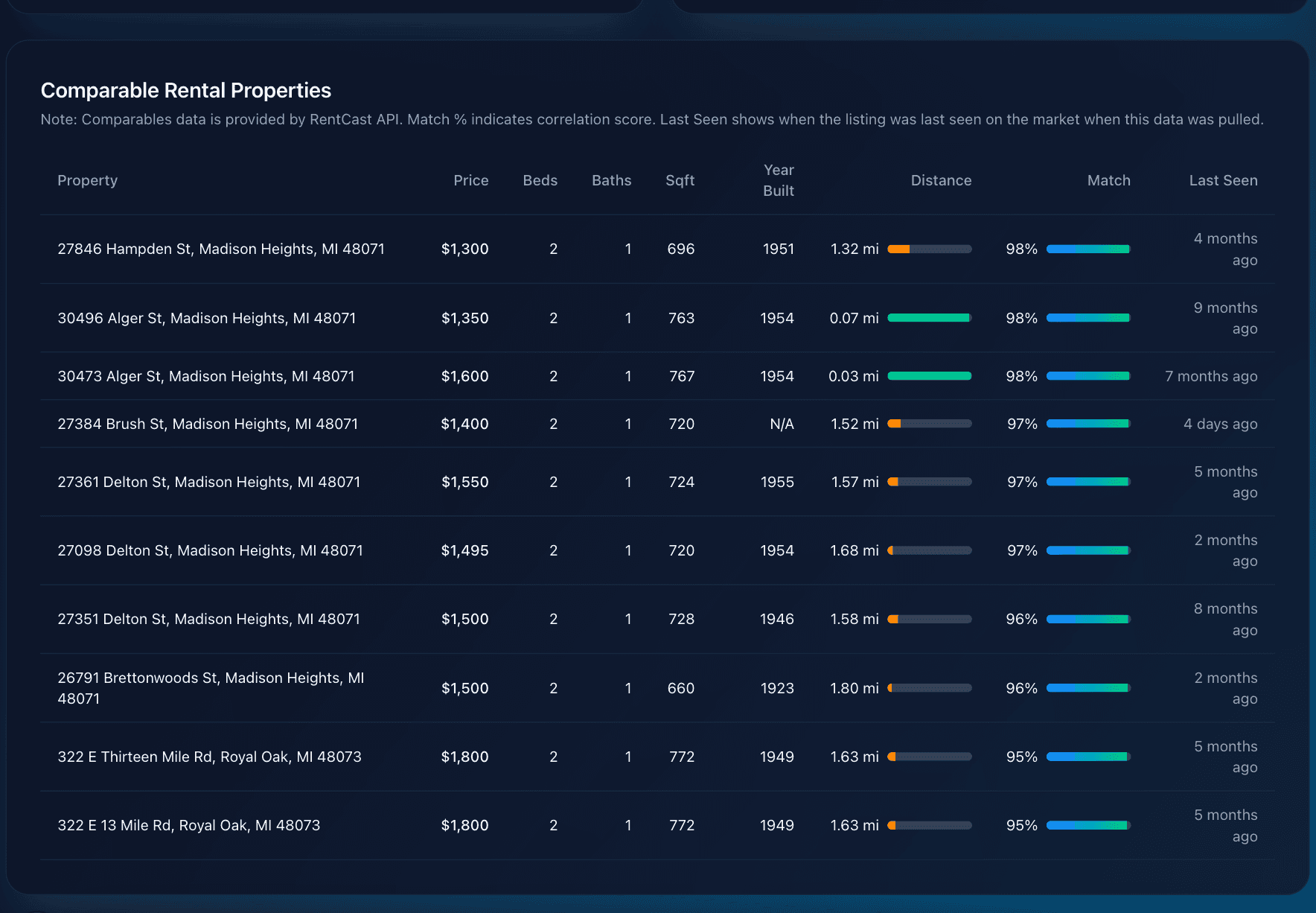

Validate your assumptions with detailed comparable rental properties. See match scores, distances, and key metrics to ensure your pricing strategy is backed by real market data.

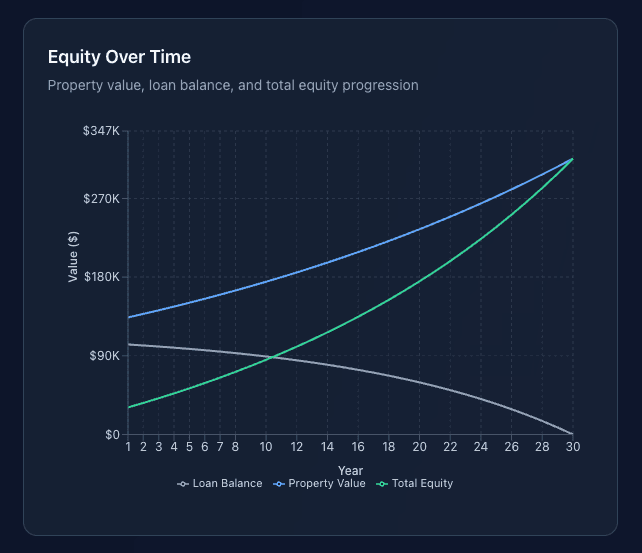

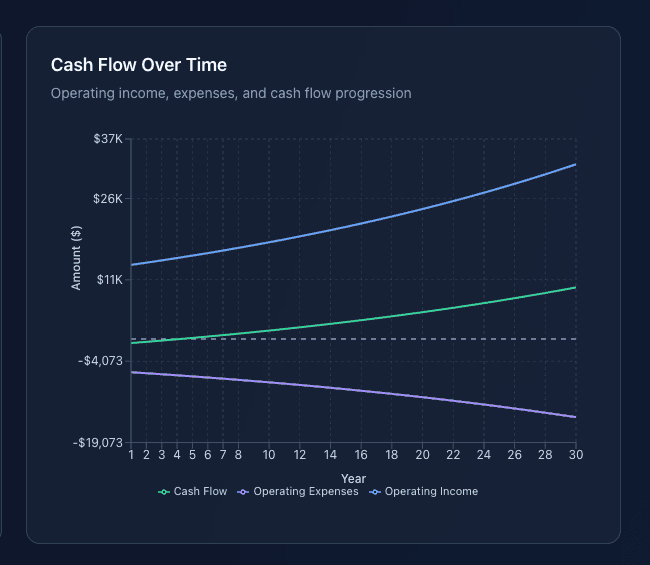

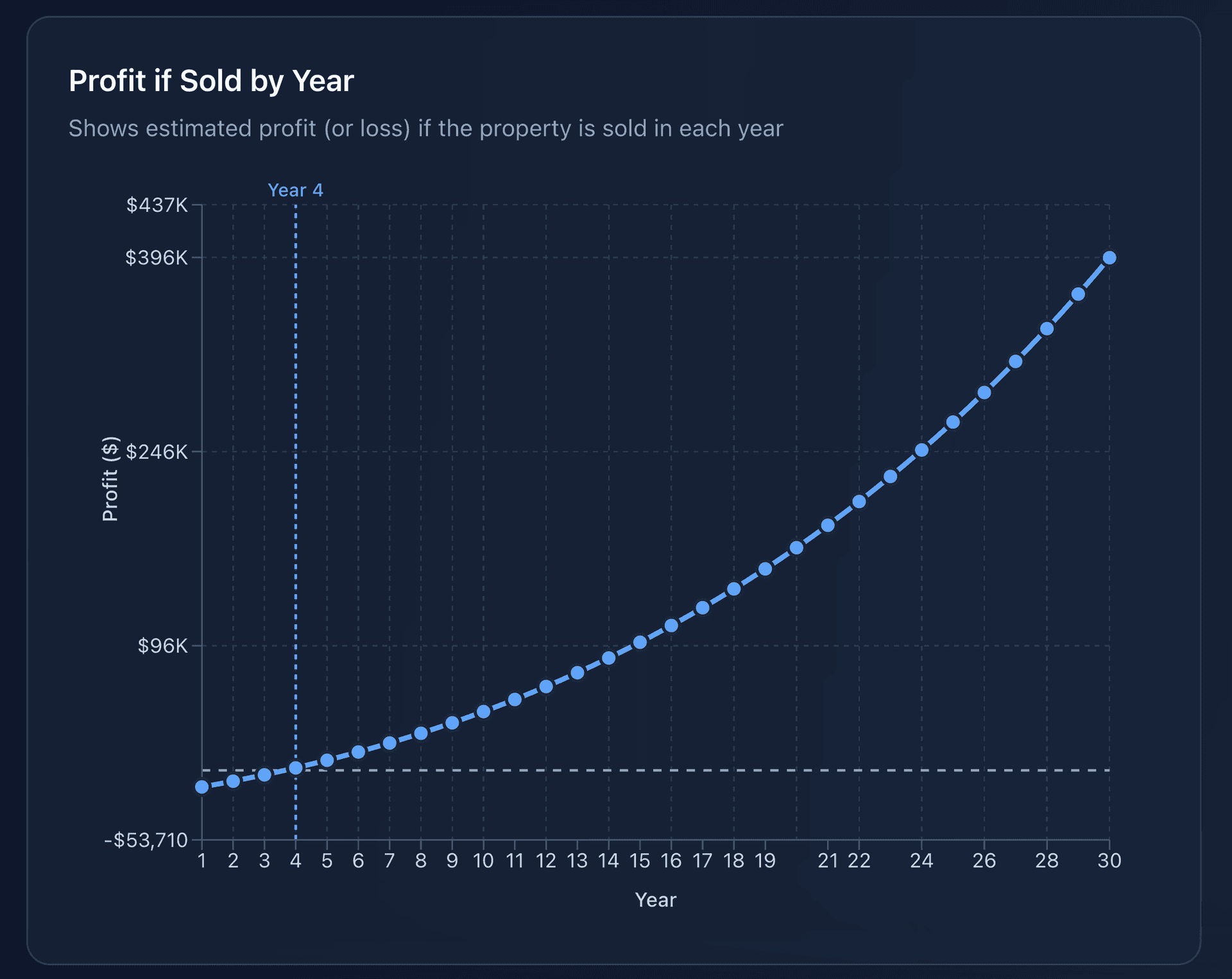

Interactive charts and graphs make complex financial data easy to understand. See how your investment performs over 30 years with beautiful, interactive visualizations.

Track property value and equity accumulation over time

Visualize monthly and annual cash flow patterns

Interactive chart showing optimal sale timing for maximum profit

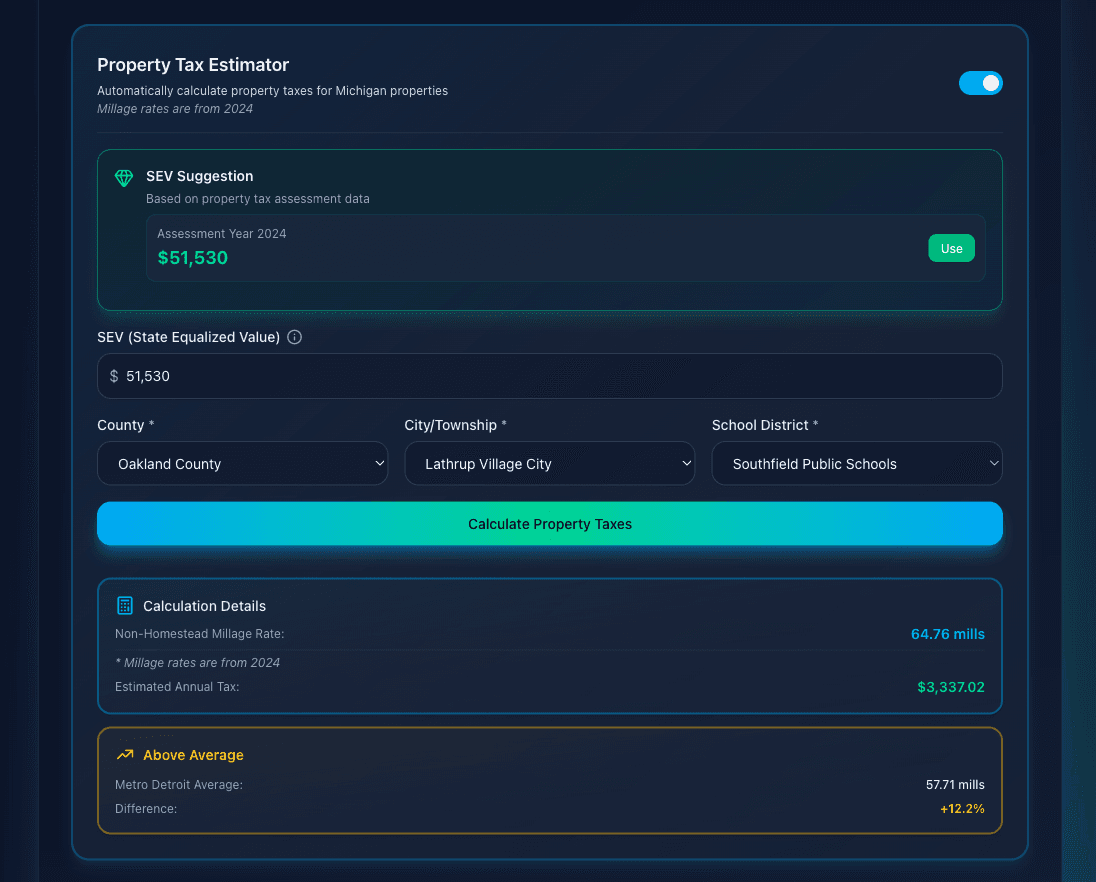

Our platform includes comprehensive Michigan tax data with accurate millage rates for every county and school district. No more guessing or manual calculations.

Powerful features designed specifically for real estate investors

Calculate monthly and annual cash flow with detailed expense tracking

Multiple ROI metrics including cash-on-cash, total ROI, and annualized returns

Track depreciation, interest, and other tax deductions over 30 years

30-year financial projections with appreciation and rent growth

Generate comprehensive PDF reports for each property analysis

Automated market data and property insights enhance your assumptions and simplify complex analysis

Check out what our users have to say.

"Michigan Rental Analyzer makes finding my next rental investment a breeze. A few simple inputs and I have exactly what I need to make an informed decision. I know I can trust the accuracy of the real time data."

"This is the best tool I've found for buying in Metro Detroit. Most sites give you a 'guess' on property taxes that is way off, but this service actually gets the numbers right. It's the only one I've used that accurately shows what you'll actually be paying instead of just showing you the old owner's tax rate. Highly recommend if you want to avoid any surprises!"

"This is a really handy site. It's easy to use and breaks down all the numbers clearly, so you can quickly see cash flow, expenses, and returns. I like that you can compare a property to other rentals nearby—it really helps put the deal in context. Overall, it's a great tool for getting a quick, realistic look at Michigan rental properties."

"The rental comparables feature is a game-changer. I can validate my assumptions with real market data in seconds."

"As someone new to rental property investing, this tool was exactly what I needed. It's easy to use and delivers a detailed, personalized breakdown of all the key metrics in one place. I'll absolutely continue using it for every property I analyze."

"This rental analyzer was invaluable when I was trying to research rental properties. The UI is easy to navigate and accessible for people with zero knowledge in real estate. Can’t wait to see what other features are on their way!"

"I came to Michigan Rental Analyzer with zero real estate experience, and it made everything feel surprisingly clear and easy to understand. The step-by-step guidance and automatic calculations took all the guesswork out of analyzing a rental property and helped me feel confident about the numbers. It honestly felt like a friendly guide that made a complex topic way more approachable!"

"Michigan Rental Analyzer makes finding my next rental investment a breeze. A few simple inputs and I have exactly what I need to make an informed decision. I know I can trust the accuracy of the real time data."

"This is the best tool I've found for buying in Metro Detroit. Most sites give you a 'guess' on property taxes that is way off, but this service actually gets the numbers right. It's the only one I've used that accurately shows what you'll actually be paying instead of just showing you the old owner's tax rate. Highly recommend if you want to avoid any surprises!"

"This is a really handy site. It's easy to use and breaks down all the numbers clearly, so you can quickly see cash flow, expenses, and returns. I like that you can compare a property to other rentals nearby—it really helps put the deal in context. Overall, it's a great tool for getting a quick, realistic look at Michigan rental properties."

"The rental comparables feature is a game-changer. I can validate my assumptions with real market data in seconds."

"As someone new to rental property investing, this tool was exactly what I needed. It's easy to use and delivers a detailed, personalized breakdown of all the key metrics in one place. I'll absolutely continue using it for every property I analyze."

"This rental analyzer was invaluable when I was trying to research rental properties. The UI is easy to navigate and accessible for people with zero knowledge in real estate. Can’t wait to see what other features are on their way!"

"I came to Michigan Rental Analyzer with zero real estate experience, and it made everything feel surprisingly clear and easy to understand. The step-by-step guidance and automatic calculations took all the guesswork out of analyzing a rental property and helped me feel confident about the numbers. It honestly felt like a friendly guide that made a complex topic way more approachable!"